Global equity market volatility in August caused a large rotation of investor capital from equities into sovereign debt, high grade corporate bonds, precious metals such as gold and defensive equity sectors led by utilities and REITs. In addition, an important trend in the markets prevalent for a long period has been the clear outperformance of growth over value equities and the price leadership of stocks driven by the momentum factor.

These trends are shown in the charts below:

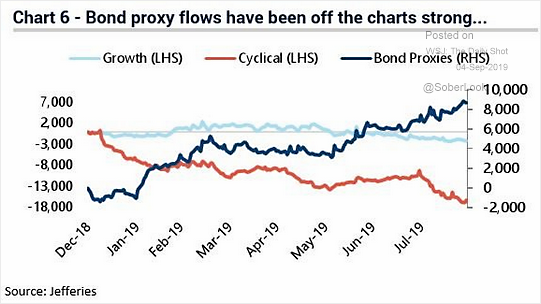

Bond proxy (utilities, REITs) fund inflows have been impressive.

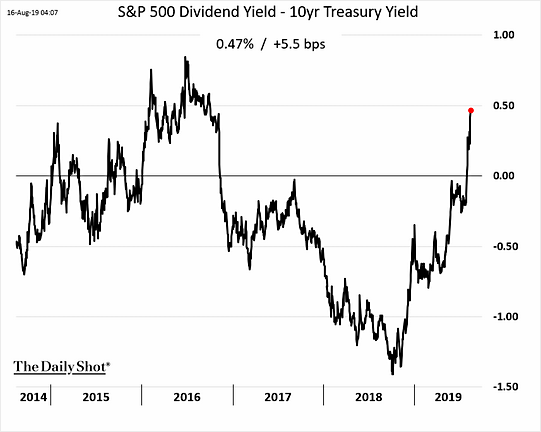

The spread between the S&P 500 dividend yield and the 10yr Treasury yield has greatly increased.

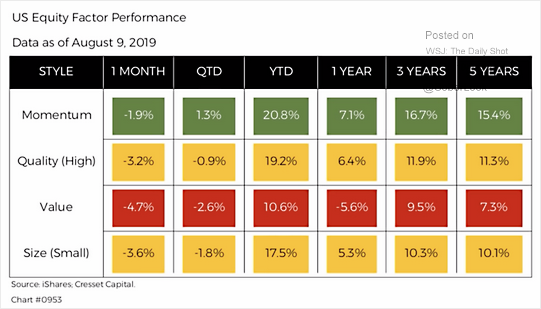

The momentum factor has consistently outperformed value over the past five years.

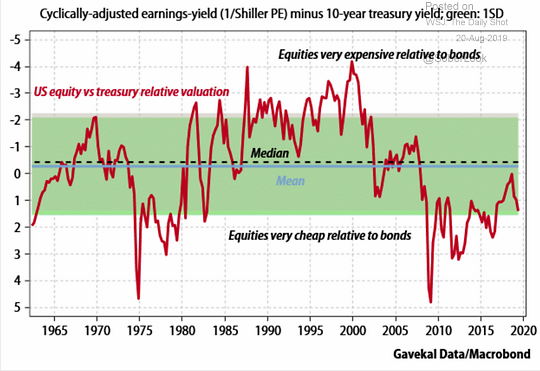

If bond yields stay near current levels, equity valuations are cheap .

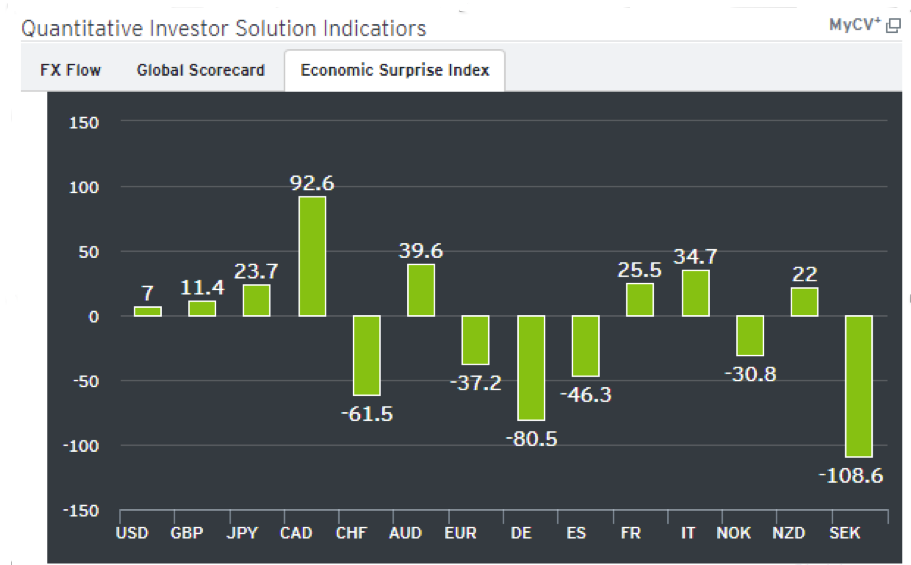

Over the past several days, we at Clearbrook have witnessed a seismic shift in global investor capital flows and sentiment that seen a massive rotation from the defensive sector (bond proxies), growth and momentum into value stocks. The impetus behind this move has been prompted by the dovish stance of the global central banks restarting the QE engine, and the recent improvements in hard global economic data. In the chart below from Citigroup, we can see that positive upside surprises in economic data from the US, Japan, Canada, France and Italy have turned investor sentiment in regards to global growth prospects. This is leading investors to seek out sectors that can benefit from a revitalization in economic growth such as energy, industrials, materials and perhaps even financials.

Quantative Investor Solution Indicators

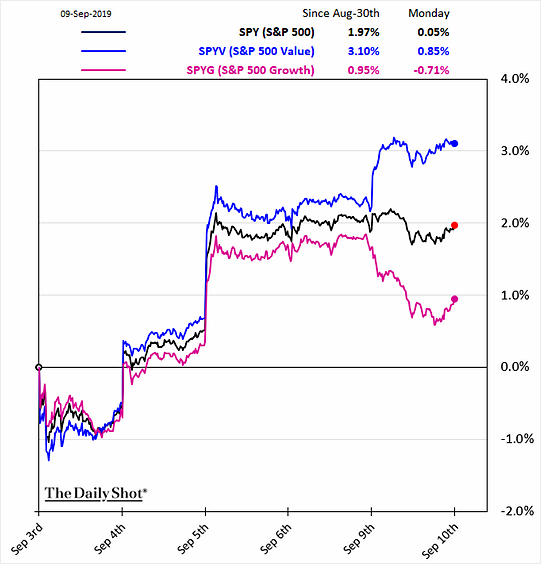

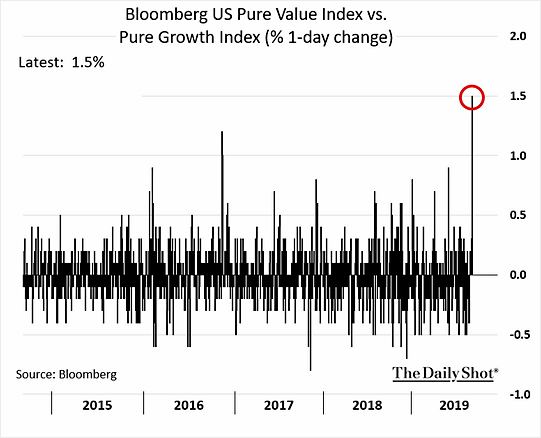

This shift has been tantamount to a four-standard deviation move, which has occurred only three times over the last ten years according to Citigroup. This large change in investor sentiment is also causing performance disruption for hedge funds that have performed well being long growth and momentum names, while shorting value sectors and equities. We believe this sector rotation will continue for a while, as the outsized outperformance of growth versus value over a long period of time would eventually lead to a reversion to the mean in regards to performance and valuations. As a result, Clearbrook has increased its allocation to U.S. domestic value oriented investment funds to take advantage of this performance discrepancy between growth and value.

Is the underperformance of value stocks finally over?

S&P 500 value vs. growth rotation:

Value vs. growth daily changes:

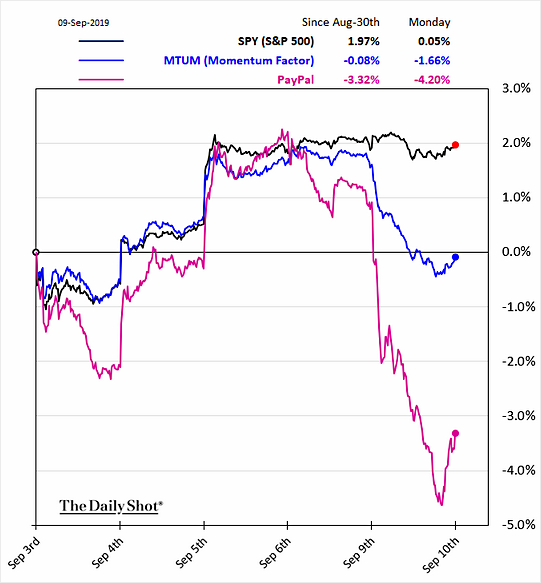

Momentum: